The 60-second version: Sales data and SEO measurement

- Traffic growth without revenue connection leaves SEO budgets vulnerable to cuts

- Three sales data points matter most: closed-won revenue, pipeline value by source, and lead-to-deal conversion rate

- Realistic CRM-SEO integration takes 4-8 weeks, not the 2 weeks vendors promise

- Start with first-touch attribution before attempting complex multi-touch models

The Traffic Trap: Why Organic Growth Metrics Mislead Leadership

In my work with B2B marketing teams across the UK (around 40 SEO audits between 2022 and 2025), I consistently see the same pattern: teams celebrate traffic increases while leadership grows increasingly sceptical. On average, it takes three to four months before executives start questioning whether organic growth translates to actual business value. This observation is specific to B2B contexts—B2C dynamics differ significantly.

The core problem sits in what we measure versus what the business cares about. According to the 2024 attribution benchmark report from 6sense, marketing teams are still not measuring what they are attempting to manage. That gap between SEO activity and revenue visibility creates the disconnect that costs marketing leaders their credibility—and sometimes their budgets.

Here is what makes this particularly frustrating. You might have brilliant accurate search visibility tracking in place, showing keyword improvements across your target terms. But when finance runs their quarterly review, they compare channels by one metric: revenue contribution. Paid media shows a direct line to conversions. SEO shows… traffic graphs.

| Metric you report | What leadership hears | Revenue-connected alternative |

|---|---|---|

| Organic traffic up 35% | More people visited. Did any buy? | Organic-sourced pipeline increased £180K |

| Ranking #3 for target keyword | Nice. What does that cost us in deals? | This keyword drove 12 qualified demos this quarter |

| Domain authority improved | Is that a real business metric? | Organic leads converting at 4.2% vs 1.8% paid |

| Blog sessions doubled | Content is expensive. What’s the return? | Blog readers who converted generated £340K revenue |

Frankly, the second column is not unfair criticism. Leadership teams run businesses on revenue and margin. Expecting them to trust traffic as a proxy for value asks them to take a leap of faith that paid media never requires. The solution is not better traffic reporting—it is connecting SEO to the metrics that already matter to them.

Three Sales Data Points That Transform SEO Evaluation

My honest take on attribution: most marketing teams overcomplicate it. They chase multi-touch perfection when they cannot even answer basic questions about which channels drive closed deals. I always recommend starting with three sales data points before worrying about sophisticated models. Get these right, and you will have enough credibility to justify the infrastructure investment for more advanced tracking later.

Start with these three sales data points

- Closed-won revenue by original source

This is the metric that ends arguments. When you can show that organic search generated £420K in closed revenue last quarter, the conversation shifts entirely. Pull this from your CRM by filtering closed deals where the original lead source equals organic. Not influenced. Original. That distinction matters when you are defending your budget.

- Pipeline value attributed to organic touchpoints

Closed revenue looks backward. Pipeline shows what is coming. Track the total value of open opportunities where organic search was a touchpoint—either first touch or anywhere in the journey. This forward-looking metric helps you forecast and demonstrates momentum even when deals have not closed yet.

- Lead-to-deal conversion rate by channel

This ratio exposes quality differences between channels. When organic leads convert at 4% while paid converts at 1.5%, you have a compelling story about traffic quality—not just quantity. Leadership understands conversion rates. They use them for sales performance reviews constantly.

One thing I have learned from dozens of these implementations: sales data accuracy determines whether this entire exercise works. If your sales team enters lead sources inconsistently, or if commission disputes mean they claim credit for marketing-generated leads, your attribution falls apart at the source. Organisations that manage sales compensation effectively with Qobra tend to have cleaner data because automated commission calculation removes the incentive for sales reps to manipulate lead source fields.

Why commission accuracy matters for marketing attribution: When sales reps believe their compensation depends on claiming lead credit, source data becomes unreliable. According to the 2025 marketing data accuracy report from Integrate, 73% of marketers admit their lead data is inaccurate or outdated—and poor data handoffs create sales inefficiencies for more than 60% of teams.

I am not suggesting you need perfect data to start. Waiting for perfection means waiting forever. But be aware that your attribution is only as good as the data entering your CRM. Start with these three metrics, clean the most obvious data problems, and iterate.

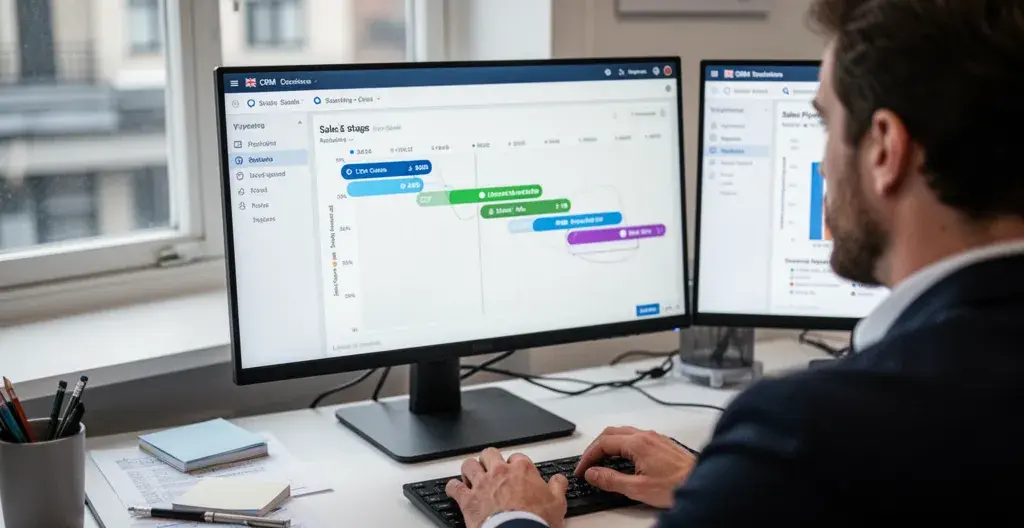

Bridging the Gap: Connecting Your CRM to SEO Reporting

I accompanied David through this exact challenge two years ago. He ran marketing for a Manchester-based procurement software company. His situation was textbook: 47% organic traffic increase, a £2.3M pipeline he could not connect to any marketing activity, and a CFO demanding proof of SEO value. The sales team tracked leads in separate spreadsheets. CRM data was incomplete. Sound familiar?

We spent six hours monthly on manual attribution before implementing an automated solution. That experience taught me what realistic integration actually looks like—not the two-week timelines vendors promise, but the messy reality of connecting systems that were never designed to talk to each other.

Reality check: If a vendor tells you CRM-SEO integration takes two weeks, they are either selling you something simple or setting you up for disappointment. According to a sales cycle research, B2B customers take about 211 days to make a purchase. Your attribution system needs to track touchpoints across that entire journey, which requires thoughtful integration—not quick fixes.

-

Audit current data sources and identify gaps in tracking -

Map customer journey touchpoints and define attribution rules -

Integrate CRM with analytics platform (expect technical hiccups) -

First reliable attribution report with validated data -

Pattern recognition begins—enough data to spot trends

The most common failure point I see happens between weeks two and four. Marketing builds the integration without involving sales operations. Then the data flows in, and sales disputes every attribution because they were never consulted on the rules. Get your sales ops lead in the room early. Their buy-in determines whether anyone trusts the numbers.

According to a data quality cost analysis cited by Dataslayer, poor data quality costs organisations an average of $12.9 million annually. You do not need that scale of problem to feel the impact. Even modest data issues—30% of transactions with no source attribution—make your SEO reporting look incomplete compared to paid channels that capture everything.

Soyons clairs: this is not a technology problem. Native connectors exist for Salesforce, HubSpot, and most major CRMs. The challenge is process and politics. Who owns the integration? Who resolves disputes? Who cleans the data? Answer those questions before you touch any technical configuration.

Your Questions About Sales Data and SEO Measurement

What if my sales team refuses to share CRM access?

This is political, not technical. Start by showing what you need and why—usually read-only access to closed deal data with source fields. Frame it as making their performance look better, not auditing them. I have seen marketing leaders succeed by offering to build dashboards that help sales, not just marketing. Give before you ask.

How do I handle leads with multiple touchpoints?

Start simple. Use first-touch attribution for your initial reporting—it tells you what channels create new relationships. Multi-touch matters, but only after you can reliably track first touch. Most teams jump to sophisticated models before mastering basics. That creates complexity without clarity.

Is this worth the effort for a small marketing team?

Honestly? Small teams benefit most. When you have limited budget, proving ROI protects every pound you spend. The alternative is defending SEO with traffic metrics while paid media shows clear revenue numbers. That is a losing position in any budget discussion.

How long before I see reliable attribution data?

Count on three months for pattern recognition. You will have data flowing within weeks, but B2B sales cycles mean you need time to see deals close. The first month feels frustrating because nothing has converted yet. By month three, you start spotting which organic entry points actually lead to revenue.

What about UK GDPR and tracking limitations?

First-party data from your CRM falls under legitimate business interest for most B2B contexts. The tracking challenges come from anonymous website visits—around 70-80% of prospect interactions happen before any form fill. Focus attribution on known contacts in your CRM rather than trying to identify anonymous traffic. That data is more reliable anyway.

The next step for your attribution

If you take one action from this article, make it this: pull your closed-won deals from last quarter and tag each one with its original lead source. That single exercise—roughly two hours of work—will show you exactly how much revenue you can currently attribute to organic search versus how much sits in an “unknown” bucket.

Your immediate action checklist

-

Export last quarter’s closed deals with source field (this week)

-

Calculate total revenue currently attributed to organic search

-

Identify percentage of deals with missing or “unknown” source data

-

Schedule 30-minute call with sales operations to discuss data quality

That conversation with David from Manchester? His team now reports organic revenue contribution alongside traffic metrics. The CFO reversed the budget cut six months later. Not because the traffic numbers changed—because the story changed. Traffic is vanity. Revenue attribution is sanity.